Mastering Payroll: Your Step-by-Step Guide to Efficiently Utilizing Payroll Summary Generator Services

Navigating the complexities of payroll management and financial reporting can be a daunting task for any business, large or small. Fortunately, technological advancements have led to the development of tools designed to streamline these processes. Among these, Payroll Summary Generator Services and Profit and Loss Statement Generators stand out as essential tools for efficient business management. This guide aims to provide a comprehensive overview of how to use these services effectively, ensuring your business stays on top of its financial health and complies with relevant regulations.

Introduction to Payroll and Financial Reporting Tools

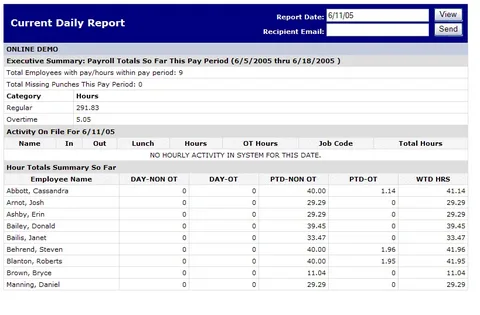

In today’s digital age, managing payroll and financial statements manually is no longer practical. Payroll Summary Generator Service automate the process of calculating and summarizing employee wages, taxes, deductions, and net pay. Similarly, Profit and Loss Statement Generators facilitate the automatic creation of financial reports, showcasing a business’s revenues, expenses, and profits over a specific period. These tools not only save time but also reduce the likelihood of errors that can occur with manual calculations.

Understanding Payroll Summary Generator Services

A Payroll Summary Generator Service is a specialized software that simplifies the creation of detailed payroll reports. These summaries are crucial for both internal record-keeping and payroll compliance with tax regulations. The service ensures that all calculations adhere to the latest tax laws and payroll regulations, providing peace of mind for business owners and HR

Key Features to Look For:

- Accuracy in calculations

- Integration capabilities with existing HR and accounting software

- User-friendly interface

- Customizable report options

- Robust data security measures

Utilizing Profit and Loss Statement Generators

The Profit and Loss Statement Generator is another invaluable tool for businesses. It automates the process of generating financial reports, which are essential for assessing the financial health of a company. These statements help stakeholders understand how the company generates revenue and incurs expenses, offering insights into areas of strength and opportunities for improvement.

Key Benefits:

- Quick and accurate financial reporting

- Helps in making informed business decisions

- Tracks financial performance over time

- Supports budgeting and financial planning processes

Integrating Payroll and Financial Reporting Tools

For maximum efficiency, it’s beneficial to integrate your Payroll Summary Generator Service with your Profit and Loss Statement Generator. This integration allows for seamless data flow between payroll and financial reporting, ensuring that all financial statements are up-to-date and accurate. It simplifies the reconciliation process and provides a comprehensive overview of the company’s financial status.

Get to Know about MyPayLA and Its Step-by-Step Process for LA Employees.

Steps to Implementing These Services Effectively

1. Assess Your Business Needs: Determine the specific features and capabilities that your business requires from these services. Consider the size of your workforce, the complexity of your payroll, and your financial reporting needs.

2. Research and Select Suitable Tools: Once you’ve identified your needs, research available tools that offer the features you require. Look for reputable providers with positive reviews and a track record of reliability.

3. Train Your Team: Ensure that your HR and finance teams are adequately trained on how to use these services effectively. This may involve workshops, webinars, or working with the service provider’s customer support team.

4. Integrate with Existing Systems: Work with your IT department or the service provider to integrate the new tools with your existing systems. This step is crucial for ensuring data accuracy and streamlining your business processes.

5. Regularly Review and Update: The world of payroll and financial reporting is constantly evolving. Regularly review your processes and update your tools as needed to comply with new regulations and take advantage of technological advancements.

Best Practices for Using Payroll Summary and Profit and Loss Statement Generators

- Maintain Data Accuracy: Regularly update employee information and financial records to ensure the accuracy of reports generated by these tools.

- Secure Sensitive Information: Implement strong data security measures to protect sensitive financial and employee data.

- Utilize Customer Support: Take advantage of customer support offered by your service providers to address any issues or questions that arise.

- Stay Informed: Keep abreast of changes in tax laws and financial reporting standards that may affect your payroll and financial statements.

Conclusion

Payroll Summary Generator Services and Profit and Loss Statement Generator are indispensable tools for modern businesses. By automating complex and time-consuming tasks, these services not only improve efficiency but also enhance the accuracy of financial reporting and payroll management. Following the guide outlined above will help you implement and use these tools effectively, ensuring your business operations run smoothly and comply with relevant laws and regulations. Remember, the key to successful implementation lies in choosing the right tools for your business needs, integrating them into your existing systems, and staying informed about the latest developments in financial and payroll management.